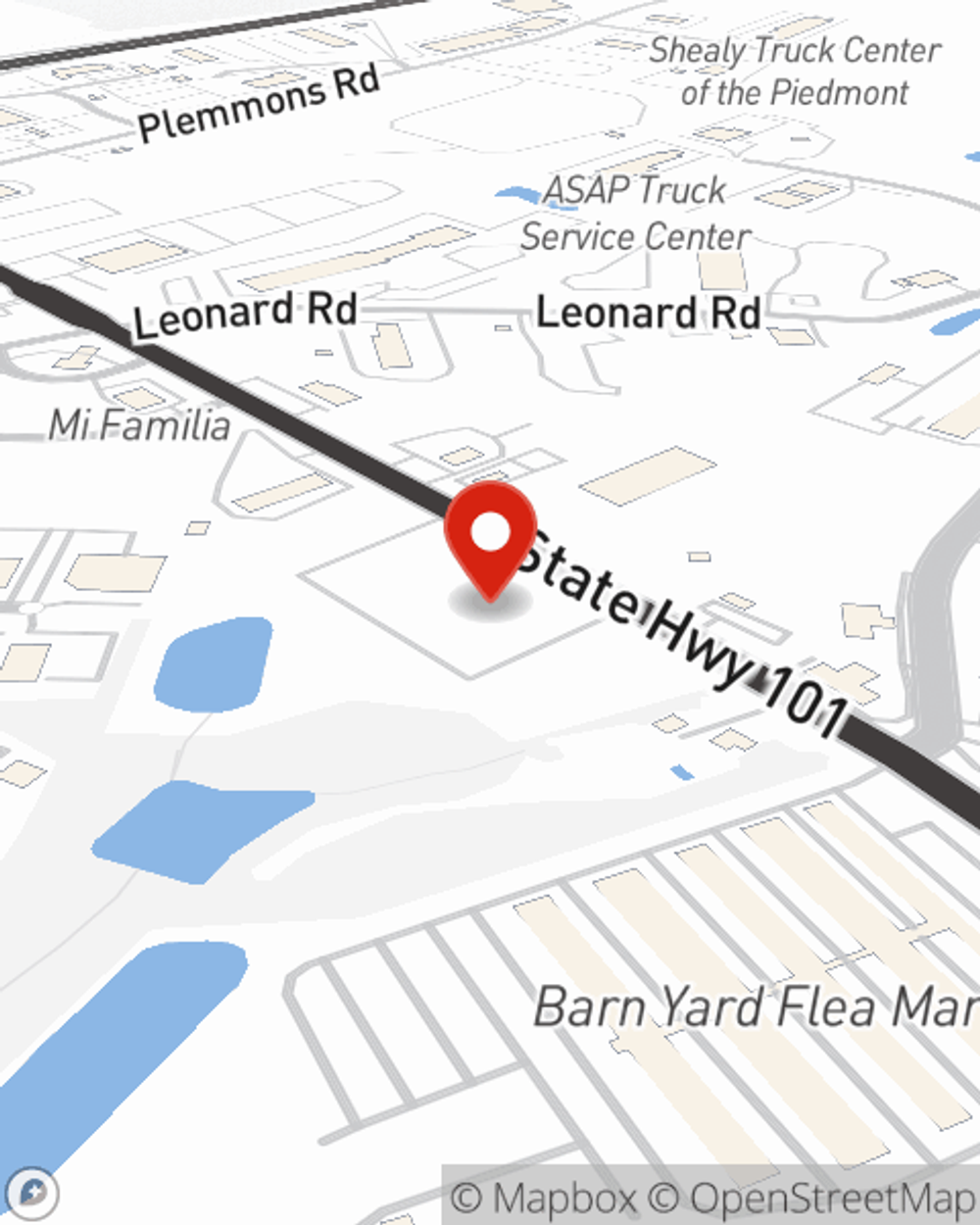

Business Insurance in and around Greer

Looking for small business insurance coverage?

Insure your business, intentionally

Help Protect Your Business With State Farm.

As a small business owner, you understand that sometimes the unanticipated does occur. Unfortunately, sometimes accidents like a staff member getting hurt can happen on your business's property.

Looking for small business insurance coverage?

Insure your business, intentionally

Protect Your Future With State Farm

No one knows what tomorrow will bring—especially in the business world. Since even your brightest plans can't predict consumer demand or natural disasters. In business, you can be certain of one thing: nothing is certain. That’s why it makes good sense to plan for the unexpected with a State Farm small business policy. Business insurance protects more than just your facility or shop.. It protects your hard work with coverage like errors and omissions liability and a surety or fidelity bond. Fantastic coverage like this is why Greer business owners choose State Farm insurance. State Farm agent Greg Heintz can help design a policy for the level of coverage you have in mind. If troubles find you, Greg Heintz can be there to help you file your claim and help your business life go right again.

Don’t let the unknown about your business stress you out! Contact State Farm agent Greg Heintz today, and discover the advantages of State Farm small business insurance.

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Greg Heintz

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.