Auto Insurance in and around Greer

The first choice in car insurance for the Greer area.

Let's hit the road, wisely

Would you like to create a personalized auto quote?

You've Got Things To Do. Let Us Help!

Daily routines keep all of us on the go. We drive to school, social gatherings, baseball practice and book clubs. We go from one thing to the next and back again, almost automatically… until trouble finds you on the road: things like vandalism, hailstorms, cracked windshields, and more.

The first choice in car insurance for the Greer area.

Let's hit the road, wisely

Great Coverage For A Variety Of Vehicles

But there are lots of ways to get where you are going and move from Point A to Point B. State Farm also offers insurance for kayaks, golf carts, trail bikes, truck campers and canoes. Whatever you drive, State Farm has you covered and stands ready to help with great savings options and attentive service. Plus, your coverage can be aligned to your lifestyle, to include things like car rental insurance and Emergency Roadside Service (ERS) coverage.

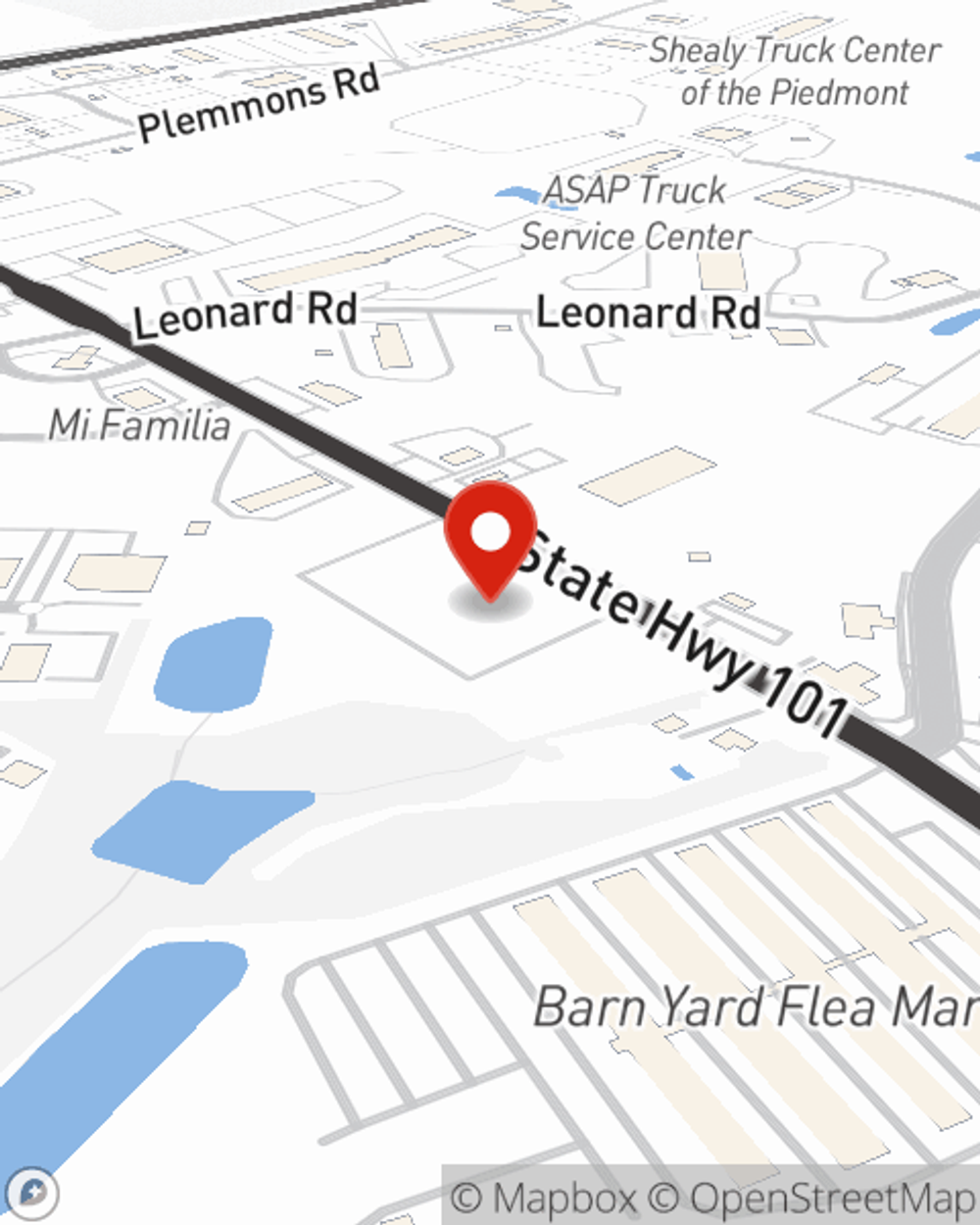

Want to see the other options that may also be available to you? State Farm agent Greg Heintz would love to walk through them with you and help you create a policy that fits your particular needs. Contact Greg Heintz to get started!

Have More Questions About Auto Insurance?

Call Greg at (864) 292-3080 or visit our FAQ page.

Simple Insights®

Bike to work? Boost your commuting safety

Bike to work? Boost your commuting safety

Bicycle commuting can be beneficial to your health as well as the environment. If you bike to work, learn how to stay safe on your two-wheel commute.

Tips for driving safely in the rain

Tips for driving safely in the rain

Driving in the rain doesn't have to be stressful and it's not good to drive as if it were warm and dry. Follow these safety tips to help you when driving in the rain.

Greg Heintz

State Farm® Insurance AgentSimple Insights®

Bike to work? Boost your commuting safety

Bike to work? Boost your commuting safety

Bicycle commuting can be beneficial to your health as well as the environment. If you bike to work, learn how to stay safe on your two-wheel commute.

Tips for driving safely in the rain

Tips for driving safely in the rain

Driving in the rain doesn't have to be stressful and it's not good to drive as if it were warm and dry. Follow these safety tips to help you when driving in the rain.